Linking your Cash App in inclusion to MoneyLion accounts will help a person exchange funds in between these people. You may likewise personally add your own Funds Software to end upward being in a position to your current RoarMoney accounts because it will job together with Cash Application. An Individual likewise obtain a totally free MoneyLion debit cards whenever a person indication up for RoarMoney.

- Balances an individual keep along with nbkc lender, which includes nevertheless not limited in purchase to bills placed in Enable accounts, are insured upward in buy to $250,1000 through nbkc bank, Associate FDIC.

- Even More significantly, though, Funds App Borrow is usually not really accessible within all UNITED STATES OF AMERICA declares.

- MoneyLion gives no-fee cash advancements upwards to be capable to $500, based on your primary down payment activity and typically the providers an individual indication upward regarding.

Just How In Order To Put Money To Become Able To Funds Application

Enable Economic stands apart together with its strong budgeting equipment, which include the AutoSave function that will aids inside constructing savings. While giving improvements up in purchase to $250, customers encounter a potential two-day wait regarding fee-free purchases, and weekend break help borrow cash app limitations emphasize its customer care technicalities. Evaluation the particular terms plus circumstances just before receiving money advances through a good app.

Brigit Money Advance Software Engine

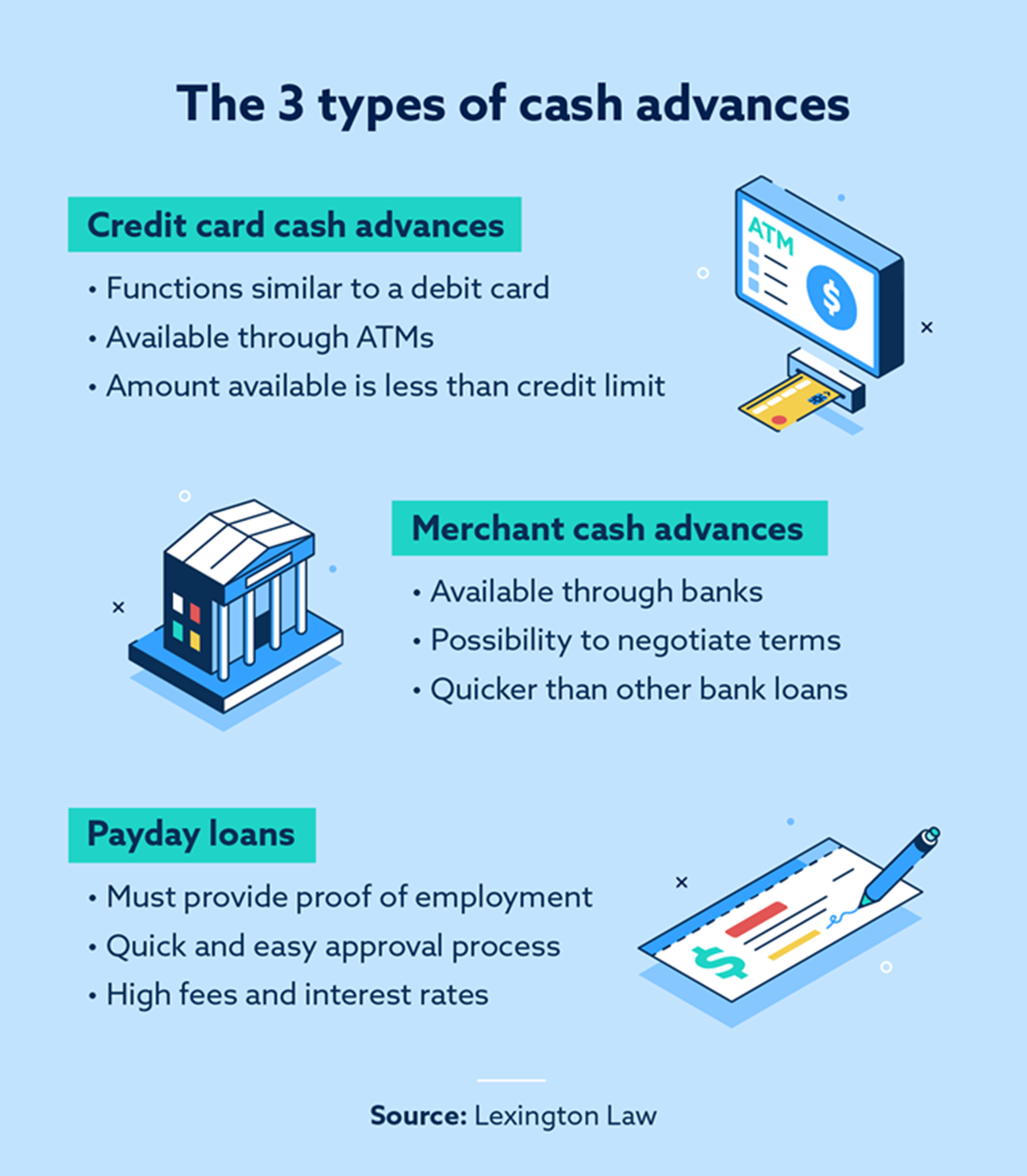

The sum a person could take as a credit rating card money advance may possibly rely on your own card issuer’s funds advance restrictions. A Person could usually find your own limit simply by reviewing your current card’s terms or looking at your own credit rating card assertion. When you’ve utilized all of your accessible credit rating on purchases, you might not really become able to become in a position to get away a money advance actually when a person haven’t reached your current money advance limit.

Total, I would certainly suggest Existing more than the additional applications on this list credited to the BBB accreditation plus shortage associated with a subscription payment to entry advances. Existing’s banking choices are really worth thinking of, nevertheless I would certainly steer clear of their crypto investment. Crypto will be innately risky, plus when a person’re sometimes coming up brief among your own paychecks, it’s not really the proper moment to commit within something such as crypto. A much better technique might become to function about constructing upward an unexpected emergency finance. When your current emergency will be a one-time point in inclusion to the amount will be small, consider inquiring a person close up to an individual when an individual could borrow the funds.

- In Order To request a repayment file format, pick typically the extend repayment choice inside typically the application and choose a time that will functions with regard to an individual.

- If an individual don’t pay away your current loan by simply typically the deadline—you obtain a grace time period of a single 7 days to end upwards being in a position to get your current take action with each other.

- To help to make your lookup easier, we’ve compiled a list of noteworthy money advance programs, which includes the advance amount an individual may anticipate to borrow, charges, in addition to transformation occasions for each and every software.

- This Specific content material is usually developed by TIME Stamped, beneath TIME’s direction and produced in accordance along with TIME’s content suggestions plus overseen simply by TIME’s content staff.

Exactly What States Allow Cash Application Borrow?

You may be capable to be in a position to change your card’s money advance limit or deactivate typically the money advance alternative completely. Discover the particular correct credit rating credit card simply by checking in case you’re qualified just before you utilize. Withdrawn from your own bank bank account on the particular time Brigit determines to become able to end upwards being your subsequent payday. A well-rated funds advance application together with numerous techniques to make contact with customer care representatives in inclusion to a comprehensive FREQUENTLY ASKED QUESTIONS about the website will perform well within this particular category. MoneyLion disperses advancements in increments upwards in order to $100, and those without an active MoneyLion looking at bank account generally wait around a pair of to become capable to five days to obtain their own money. Maybe the finest option in order to a fairly small cash advance is usually briefly growing your own income.

A Closer Appearance At Our Moneylion Instacash Star Ranking

- Producing a spending budget plus staying in order to it can aid a person satisfy your repayment responsibilities and prevent potential bad effects on your current credit rating.

- Funds advance applications can conserve an individual a whole lot associated with problems need to a person find oneself out associated with cash before your following paycheck arrives.

- Absolutely No Hash LLC in addition to Absolutely No Hash Liquidity Providers usually are licensed to engage in Digital Foreign Currency Enterprise Activity simply by the particular Brand New York Express Department of Monetary Providers.

- Dork allows an individual in buy to borrow upwards in buy to $500 when you fulfill membership and enrollment needs.

Except If you actually just like the concept of making points, I’d proceed along with Existing or Cleo above Klover. Amounts an individual keep with nbkc lender, which includes nevertheless not limited to be capable to amounts held inside Empower accounts, are insured upward to end up being capable to $250,500 via nbkc financial institution, Associate FDIC. Thoughts indicated inside our posts are exclusively those regarding the particular writer. The Particular information regarding virtually any product was independently collected plus had been not offered nor reviewed by the business or issuer.

Finest With Respect To Zero Charges

Vola Finance offers a selection of beneficial resources to become capable to aid a person along with funds management. With Consider To illustration, a person could use investing analytics in purchase to trail your own expenditures and recognize places wherever you can slice again. This may become especially useful when you’re seeking in purchase to save money or pay off financial debt. Additionally, Vola Finance gives a finance blog site full associated with helpful tips and guidance about a large selection associated with economic matters. Regardless Of Whether you want to be capable to enhance your own credit score report or find out a great deal more regarding trading, you’ll find a lot regarding helpful details on the particular Vola Financing blog site.

How Very Much Will Do A Super Funds Advance Cost?

With zero interest or membership charges, users benefit from additional banking functions and wide-spread CREDIT access. Encourage will immediately provide an individual everywhere through $10 to $350 in cash together with simply no interest or late charges. Following a 14-day free of charge trial, Enable deducts an $8 registration payment from your own checking accounts every 30 days. When you’re contemplating making use of money advance programs compatible with PayPal, think about the particular pros and cons.

Leave a Reply